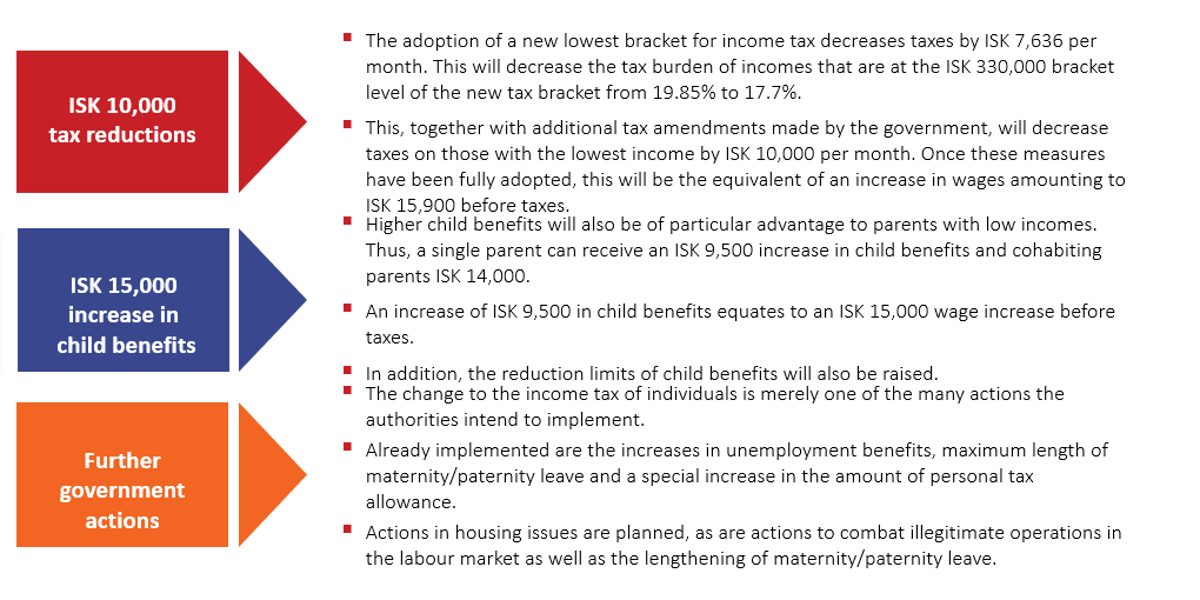

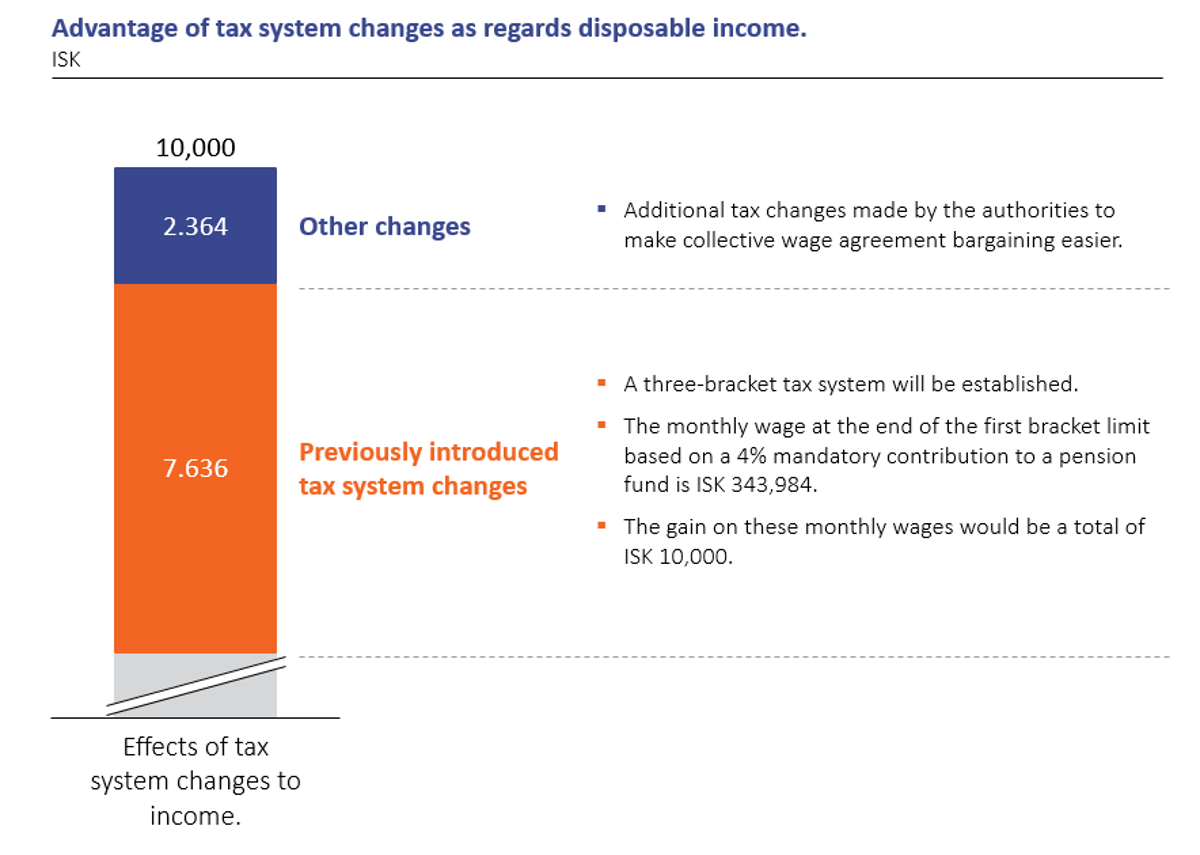

Extensive government actions during the effective term of the agreement amount to ISK 80bn and are primarily intended to strengthen the position of young parents and lower income workers. They include taking important steps toward the removal of indexation, and the effective term of indexed annuity loans for longer than 25 years will not be permitted as of 1 January 2020. In addition, new indexed loans will be based on indexes excluding housing. Authorisation to use private pension savings for apartment loans will be extended for two years. In addition, authorisation is granted to use 3.5% of pension fund premiums, tax-free, toward housing purchases. Further changes will be made to the tax system that involve tax decreases by a total of ISK 10,000, once fully implemented. This is the equivalent of an almost ISK 16,000 increase in wages before taxes.

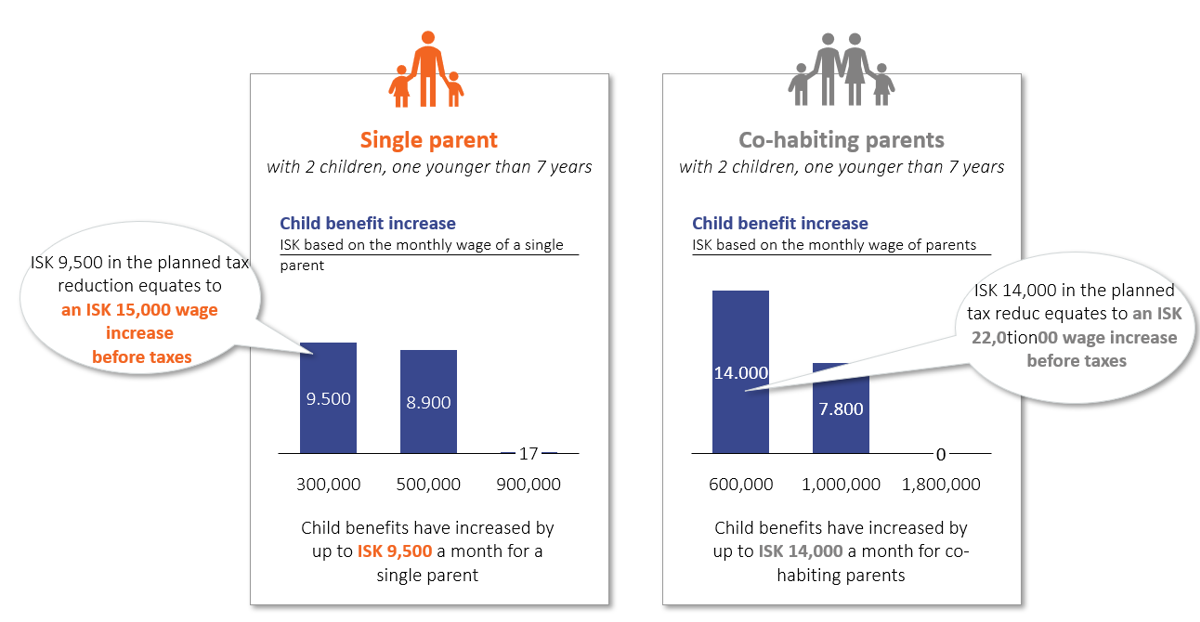

Changes to the child benefit system, i.e. the increase of benefits by approximately 16% and the raising of reduction limits to ISK 325,000 per month, will also significantly benefit lower income workers and households.

Tax decrease

Child benefits

Government actions: Child benefits increased as do their reduction limits.

Summary: Tax reductions and other action implemented by the authorities